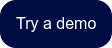

Identity fraud was tackled with great insight and urgency in a session titled “Conversations about AI: Cybersecurity and Digital Identity.” This event, hosted by Españoles Científicos en USA (ECUSA) and the Embassy of Spain in Washington, D.C., brought together experts to discuss the challenges and advancements in combating identity fraud in the US. Mikel Sánchez, Sales Engineering Global Director at Veridas, presented the session in collaboration with Daniel Bachenheimer of Accenture.

The Scope of Identity Fraud

Identity fraud is growing in the United States, affecting 42 million Americans in 2021 alone. The discussion highlighted the sophistication of modern identity fraud techniques, particularly focusing on the rise of deepfakes. These AI-generated fake identities pose a severe threat as malicious actors use them to erode public trust. The speakers emphasized the urgent need for advanced detection and authentication technologies to counter these threats effectively.

The Role of Biometrics

Mikel Sánchez shared valuable insights from the company’s extensive experience in identity verification. Since 2017, Veridas has conducted over 100 million identity verification processes. Sánchez pointed out that with the rise of generative AI, the cases of fraud and impersonation have become more sophisticated. However, he firmly stated, “machine does not fool machine.” He underscored the reliance on biometrics as the most secure method of identity verification, highlighting the daily challenge of emerging new attacks and the constant evolution needed to stay ahead.

Identity Fraud in the Digital Environment

Identity fraud is not limited to any single country. In Spain, a gang using false identity documents swindled 1,600 people. The UK saw more than 277,000 identity fraud cases in 2022. Across Europe, 8% of Europeans claim to have suffered identity theft. Mexico also faces challenges with digital identity theft, which is growing by 52%.

Fraud Attempts: Types and Elaboration

During the session, Mikel Sánchez explained various types of fraud attempts, providing detailed insights into how fraudsters operate. He covered methods such as using photocopies, where attackers capture a photograph of a genuine ID document, modify personal data using photo editing software, and print the altered document on different media. Another method is photos to screen, which involves attackers using edited photos displayed on screens (computer, smartphone, etc.) and capturing an image of the fake document shown on the screen. Photo impersonation involves fraudsters printing a photo of their face, cutting it out, and placing it over the victim’s photo on the document to match biometric data during verification processes. Manipulation of printed information includes altering personal data on documents by overlapping or replacing certain elements, such as MRZ codes or other critical data fields.

Other sophisticated fraud attempts include creating high-quality fake documents using polycarbonate materials, often generating multiple identities with the same face but different names. Facial impersonation involves attackers using fake facial images and techniques like displaying a fake selfie photo on a screen or using a high-quality mask. Deepfakes and injection attacks involve creating synthetic identities using deepfake technology and injecting these images into the verification system, making them appear real during onboarding. Additionally, synthetic voices generated through voice-generative AI are used to mimic real individuals, deceiving voice-based authentication systems. These varied methods highlight the need for robust and sophisticated detection technologies to combat identity fraud effectively.

Finding a Best-In-Class Algorithm

Despite the challenges, there is good news. In 2022, less than 1.5% of all successful digital attacks were due to compromised biometrics. To ensure the effectiveness of biometric algorithms, institutions like the National Institute of Standards and Technology (NIST) conduct regular tests involving millions of deepfake attack attempts. These benchmarks help financial institutions identify top-performing algorithms and build a robust, secure, modern tech stack. Veridas is proud to be among the world elite in this sector, with NIST ranking its algorithm second among nearly 150 submitted facial biometrics engines.

This session underscored the critical importance of continuous innovation and collaboration in the fight against identity fraud. By leveraging advanced technologies and focusing on user experience, the industry can make significant strides in protecting identities and fostering trust in the digital age.